Once more, Dutch online food delivery companies Crisp, Jumbo, Getir, and Picnic are grappling with substantial financial setbacks. The recent closure of Dutch Pieter Pot adds to the challenges, signaling that these issues extend beyond typical growing pains. In addition, the escalating minimum wages and the cost of light electric vehicles in the last mile are set to escalate the overall costs for online food retailers. The critical question remains: How can the path to transforming e-groceries into a sustainable and profitable business model be navigated?

Consumers have embraced online food shopping, and with a market share ranging from 6 to 8 percent, e-groceries have firmly established their presence, captivating the preferences of 23% of Dutch consumers. This market is estimated to be worth nearly 5 billion euros in the Netherlands, as research from Dutch FSIN indicates. Moreover, the Dutch meal delivery market is experiencing robust growth, reaching around 3.5 billion euros. In light of these promising figures, the focus is now on online food retailers to demonstrate their ability to generate profits in this evolving landscape.

Operational excellence

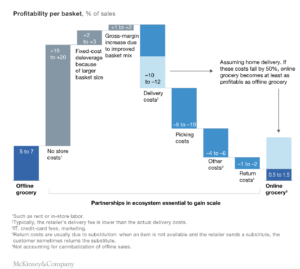

Online food delivery is about tight control of warehousing, transportation, and purchasing costs. Today, more people are working in online warehouses than in deliver-to-store warehouses. More drivers are on the road for online deliveries than for store deliveries. McKinsey wrote back in 2019: get big, or get out. Researchers even doubt whether profits can be made and whether the delivery model is scalable.

Source: McKinsey (2018) Reviving grocery retail: Six imperatives

The trend towards increased robotization and adopting e-commerce-ready packaging to mitigate handling costs is unavoidable. Among the major contributors to warehousing expenses, personnel costs stand out prominently. While a human order picker can handle 300 to 400 orders per hour, modern robots exhibit remarkable efficiency by processing as many as 900 to 1,200 products within the same timeframe per employee. By optimizing warehouse processes, the cost of picking an order can be slashed by 2 to 3 euros per order, signifying a substantial opportunity for cost reduction and operational enhancement.

Additional prerequisites for achieving profitability encompass maintaining minimal supply chain inventories, implementing seamless supply chain planning, and effectively addressing waste in collaboration with supply chain partners and consumers.

Traditional food retailers hold a distinct advantage over newcomers, courtesy of their established European purchasing contracts. Even a marginal reduction of 1 or 2 percent in purchase prices can be a game-changer. This advantage is further pronounced when online retailers collaborate with European partners, accessing a network of private label manufacturers and local entities with concise, localized supply chains. This collaborative approach enhances efficiency and flexibility in the supply chain, contributing to the overall competitiveness of online food retailers.

Service levels

The notion of free delivery is illusory. In e-groceries, the last-mile transportation cost ranges from 10 to 15 euros per delivery. While I acknowledge the complexity of the last mile, it’s worth noting that a DHL delivery driver handling parcels completes around 200 deliveries per shift at a last-mile cost of 1 to 2 euros per delivery. In contrast, e-grocery companies typically manage 12 to 24 deliveries within a 4 to 6-hour shift. This prompts a crucial question: Is there untapped potential for enhancing the efficiency of e-grocery delivery operations?

A larger consumer base in the same market area leads to more efficient delivery. Albert Heijn and Jumbo might need to reconsider the viability of providing consumers with an extensive selection of 60 delivery slots per week. Then you will never get the required predictability in delivery routes that Dutch Picnic has.

Opportunities abound for enhancing delivery productivity in the e-grocery sector. Companies need to explore transportation solutions tailored to the specific characteristics of neighborhoods, utilizing both small and large electric delivery vehicles. Additionally, incorporating pick-up points and implementing highly efficient ‘milk-run’ planning are essential components of a smart and effective delivery strategy.

With Albert Heijn’s Buurtroute plan, neighborhood residents’ delivery moments are linked. When choosing a delivery time, consumers can see when a delivery driver is already in their neighborhood. Consumers save delivery costs and Albert Heijn delivery kilometers if they choose that option. The earlier Albert Heijn Compact initiative was not successful.

Assortment and price

Consumers seem to spend less online, FSIN states. The order value must rise to more than €100 for a solid financial model. Deloitte research shows that Albert Heijn and Jumbo consumers spend almost €95 per delivery, while Picnic is well below that at €55.

Online retailers are committed to catering to the diverse needs of their cherished consumers. This entails meticulous considerations such as determining the optimal service level, managing delivery costs, balancing product assortment and margins, and fine-tuning personalization efforts regarding product range and pricing.

The pivotal question becomes: How can providers effectively address the various stages of the customer journey and encourage customers to make informed and efficient choices? Additionally, what prospects exist for ready-to-eat meals within the home delivery market, and is delivering directly to the kitchen still a financially viable option? Lastly, in the B2B market, what unique opportunities and advantages can be harnessed through delivery services?

Hellofresh inspires and has been able to grow margins over the past ten years. UK Ocado’s online retail arm returns to profit (in 2023) amid sales rising as it offers more M&S food. Sales rose by almost 11%. More efficient ways of working, including new robotic picking arms and the opening of a new hi-tech warehouse, have helped to keep costs down, with Ocado requiring just 10 minutes of human labor time to pick a 50-item order compared with more than an hour for supermarkets that fulfill online orders from stores.

Working smarter together

The evolution of artificial intelligence presents compelling opportunities to optimize delivery operations by achieving more deliveries with fewer vehicles and drivers. In the United States, Instacart leverages data to enhance the precision of delivery time predictions. Conversely, Amazon strategically employs data to streamline deliveries by selecting the most convenient warehouse.

Closer to home, AH Online is pioneering a neighborhood-centric route called the “Buurtroute.” Notably, Picnic stands out as an industry leader, setting the pace in effectively utilizing artificial intelligence within delivery services.

The food sector is at the forefront of embracing data sharing with GS1 in retail stores. Nevertheless, the sector is still in its early stages regarding data standardization for home delivery.

Anticipating a wave of new initiatives in the online food retail sector, the question arises: Is the path forward to “get big” or “get out,” or can the sector collectively strive for a more intelligent and collaborative approach? The evolving landscape promises exciting developments, and the industry’s response to these challenges will likely shape its future trajectory.

Walther Ploos van Amstel.

Also, check out this CBRE research.